Gold Saving

Buying gold with a small initial investment can increase asset value and future earnings over time. Another way to invest by using DCA (Dollar-Cost Averaging) method to diversify risk and reduce investment fluctuation is to invest consistently and evenly each month as money is deducted from an automatic bank account (ATS). Begin making a good discipline of saving money each month.

Type of gold

![]() Gold bullion 96.50 %

Gold bullion 96.50 %

Savings details

Start saving at 500 baht per month

Accumulated gold buying once a month, every 2nd business day of the month (excluding Saturdays, Sundays and public holidays).

Bullion can be obtained from the weight of 1 gram.

We have a savings plan consultant available on Monday – Friday from 9:00 – 16:30

Automatic bank transfer (ATS) every 1st business day of the month (excluding Saturdays, Sundays and public holidays)

Able to change saving limit through the system

Able to sell gold in the system and receive money within 1 business day

No additional transaction fees

Trading Unit

The unit of gold purchasing is in grams and baht (1 baht of gold equals 15.244 grams).

The advantages of gold saving

How to start your Gold Saving?

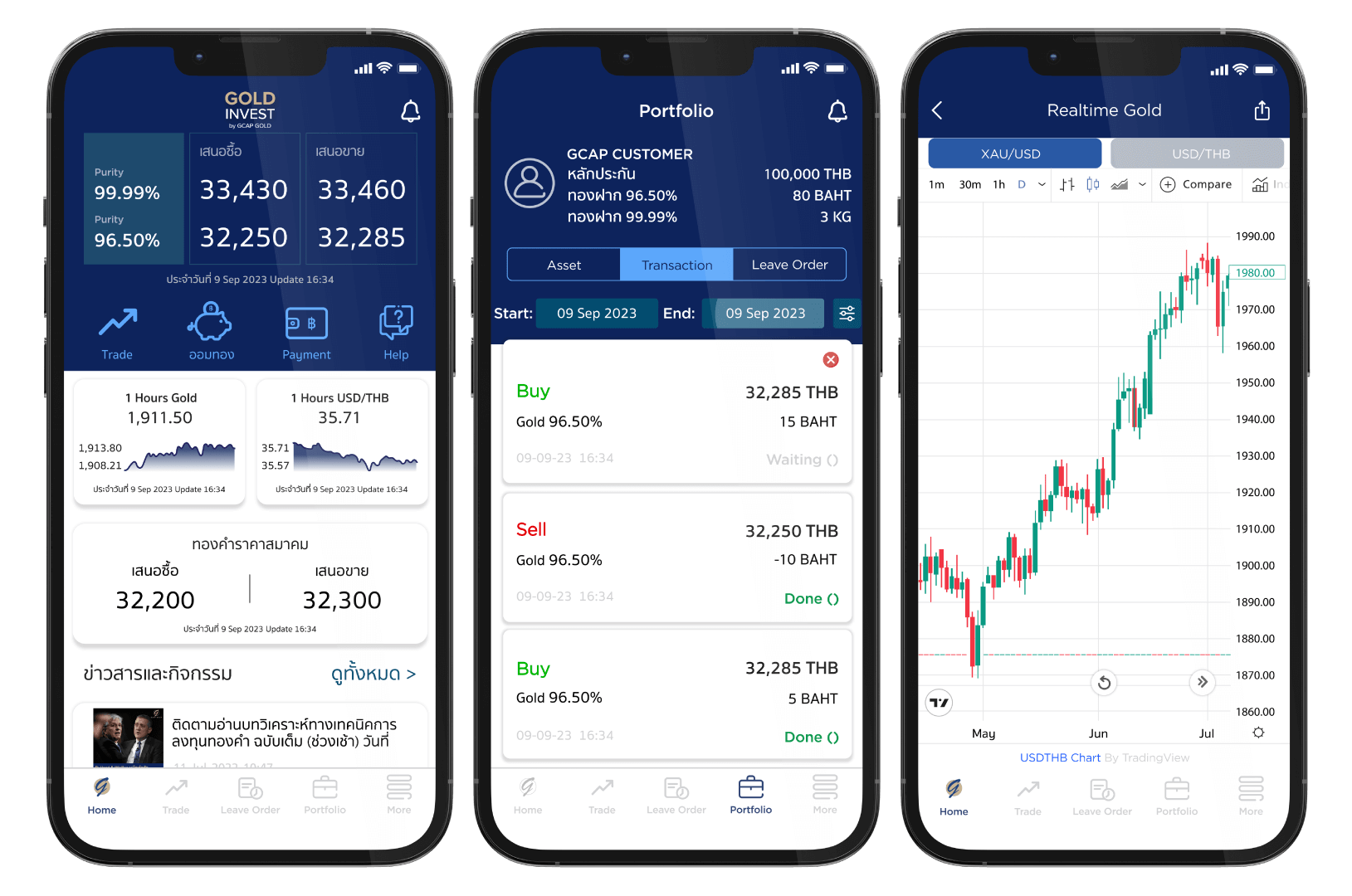

GOLD INVEST By GCAP

Gold saving through the GCAP application

Gold Saving Online System

For customers who’re inconvenient to come to the company

Apply by yourself at the company

For customers who are convenient to come to the company

How can I check my gold saving status?

Application GOLD INVEST

www.gcap.co.th/aomthong

e-Statement

Receive documents by email

Online system

www.gcap.co.th/aomthong

Call : 02-6110500

Phone call for information

Contact our Gold Saving consultant?

For more details

Chat with us